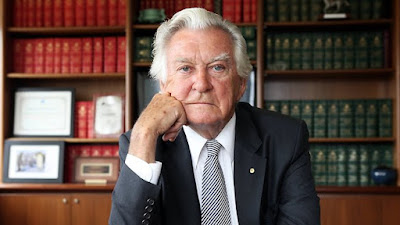

Above: Bob Hawke's policies of 'Consensus' and 'the Accords' were popular vote winners - But not all of those policies' long term ramifications were positive

What follows are another series of letters - sent by myself (Tristan Ewins) to The Age, The Herald Sun, and QandA over the past few months. Again: none were published.

Dr Tristan Ewins

Is a new ‘Hawke-ian’ Consensus ‘The Way Forward’ in Australia?

“Mark Kenny (11/7) looks forward to a new, ‘Hawke-style’ consensus – nutted out between employers, unions, welfare groups. As opposed to the “partisanship” and “populism” recently on-show. But the Accord Era was in some ways only made possible by a particular conjuncture of union coverage, mobilisation and capacity to deliver. In any case, the wage restraint that was delivered by organised labour was rewarded only with modest social wage measures. (not with transition to some Swedish model) Employers won-big under Hawke and Keating. Their support was of assistance in Hawke’s assumption of power. But as industrial demobilisation took hold, union militancy became reviled. The hope of union policy influence was steadily quashed as demobilisation meant unions had not-enough to bargain with. Today organised labour still declines slowly; and many employers see no interest in multi-lateral compromises which offer unions a meaningful ‘seat at the table’. We are left with ‘convergence politics’ based on neo-liberalism, technocracy, cosmopolitanism and globalism. What we really NEED is deep pluralism and authenticity in politics. Where democratic conflict is an accepted feature of liberal/social democracy. Where labour, welfare, environmental and other movements join together in solidarity with a broad ‘counter-culture’ or 'counter-hegemonic historic bloc'.”

What are our priorities on gender equality?

Jessica Irvine (‘The Age’, 24/7) argues advancing women’s interests and the economy involves making men feel “less confident” and to “sense…their…limitations”. She sees men’s competitiveness and over-confidence as shutting women out, helping precipitate disasters like the Global Financial Crisis. Women’s and men’s learned behaviour may be a factor: so long as we don’t resort to ‘attributing a bad essence’. But perhaps more importantly capitalism involves instability, waste, crisis, painful ‘corrections’. Is the ascent of women to positions of power within capitalism an answer to this? Or is it a problem with the dynamics and resultant priorities of the capitalist system itself? It is right to elevate women’s position in the labour market, public life, in sport – with the aim of ‘flux’ around the point of equality. If our principle is equality, though, we should also be concerned with the decline of men’s participation and performance in education. Also, for most women, labour market regulation and social wage enhancement could be more substantial than ‘a woman in the US Federal Reserve’. That is: “lift up” and respect ‘traditional women’s vocations’ in nursing, aged care, retail, hospitality, tourism, teaching, cleaning, child-care. We need solidarity between women and men to ‘lift us all up’, and not leave anyone behind.

Economic Inequality in Australia

Social research by the ‘McKrindle Group’ (Herald-Sun, early August 2016) observes increasing inequality between Australians. The top 20% have 12 times the income of the bottom 20%. And the top 20% have 71 times the wealth of the bottom 20%. There are many causes. The impact of labour market deregulation on the lower end. Threadbare, punitive welfare. A weaker labour movement. Prevalence of part-time, insecure work. Retirements are pushed back until 70 ; and for some the intensity of work increases to increase profits, and expand markets and purchasing power - which prolongs the viability of capitalism. Outcomes we get from labour markets and the inheritance of private wealth are not always fair. Some skilled workers (eg: aged care nurses, child care workers) are exploited because private labour markets cannot sustain more without government subsidy. Some do unpleasant work, perhaps with unsocial hours. (eg: cleaners) – But this is not factored in where ‘demand and supply’ for skills rules. This unfairness shows why we need a ‘social wage’, ‘social insurance’ and welfare state – financed through progressive taxes. And also labour market regulation and labour union rights - to prevent unfair outcomes. Hence the centrality of the principle: “from each according to ability, to each according to need”.

Loneliness amongst the Aged ; and Aged Care Priotiries

James Bartholomew (‘The Age’, 29/7) identifies the scourge of loneliness amongst the elderly: and the responsibility of family to ameliorate that. But this is not solely a private responsibility. Just as charity cannot replace welfare for want of resources, neither can all families manage alone without assistance. A National Aged Care Insurance Scheme would surpass ‘user pays’ for Aged Care, improving the quality of care, while provided from an egalitarian Levy. There would be ratios for Registered Aged Care Nurses, as well as for other Aged Care workers. Standards would be upheld not only in areas like food quality, but in resident health, satisfaction and happiness, and access to communications and information services and technology. To tackle isolation, social interaction would be facilitated for a variety of interests - both for those in care, and those at home. And combatting the trend to suicide—which mainly affects men. There would be home visits, and greater mobility ; with social outings, travel vouchers and associated services. Finally, pensions must be increased to end deprivation– and financial support given when dealing with unforeseen emergencies. (eg: a broken washing machine) Yet all this would require billions ; so is undoable without tax reform.

From a Discussion in Facebook on Choice in Disability Services and Aged Care

I'm potentially well-disposed towards allowing Not-for-Profits to offer services alongside the public sector. IF they do a good job. (but the public sector must be a viable choice also) The problem is - a) that ALL the providers need enough funding to provide the services at a very good level of quality ; and b) that aged people and their families benefiting from the Scheme need the flexibility to move between providers without significant disadvantage. That is: if there's a strong element of user pays that neutralises the very 'choice' schemes like NDIS are supposed to provide. It means people with limited means have no 'practical choice' in reality where user-pays mechanisms are onerous..... So what we're talking about is getting rid of the old user pays mechanisms - which could run into the tens or even hundreds of thousands. Perhaps there could be a small co-payment just to encourage people to think carefully about their choices. And progressively scaled to capacity to pay. But that would have to be utterly negligible when compared with the existing system. To be acceptable the new system would have to overwhelmingly rid itself of user-pays mechanisms ; leaving nothing but a 'functional co-payment' - whose role is not to FUND the system ; but only to encourage careful choices.

On the issue of Debt in the Economy

Ron Fischer (Herald-Sun Letters, 3/8) points out that without mechanisms of debt the economy would no longer function. To elaborate: debt is often necessary to get a concern started. And certain kinds of investment (sourced from debt) have a multiplier effect on productivity. Take investment in certain kinds of software (eg: accounting, word processing) – or investment in skills-development– with improvements in the pace and quality of production thus ensuing. ‘Priming the pumps’ in various ways: direct payments to consumers; government fiscal policy including investment in infrastructure and services – can also have a stimulatory effect, boosting confidence of investors and consumers alike. Welfare itself can contribute as those thus-dependent spend a greater portion of their incomes on necessities. Austerity on the other hand (cutting spending, services, welfare, infrastructure investment) can have a deflationary and contractionary impact. That said: debt cannot expand forever – though the real problem in Australia is household debt rather than government debt. The economy needs structural change so we are able to address household debt without declining living standards. Industry policy to create high wage jobs with a ‘flow on’ or ‘multiplier’ effect which creates additional work based on the ensuing consumption. And re-establishment of ‘natural public monopolies’ and other investments in areas like socialised medicine – which actually improve consumption power through more-efficient service provision. For example the social democratic Nordic economies contain health costs to about 9 per cent of GDP . While In the US private sector coverage is 40% - but health costs make up 18% GDP! (Lyons, McAuley, 2015) Australia is ‘in the middle’ here – but can definitely do better!

Refuting the claim of ‘Mediscare’ : ie: Why the Liberals really are about privatising Medicare

(to ‘The Age’ and the ‘Herald-Sun’) The message from much of the media approaching the Federal election was that the erosion of universal healthcare in Australia did not comprise ‘privatisation’. Privatisation was narrowly defined as ‘selling an asset off’. Labor’s message was therefore deemed a ‘scare’. Yet upon reflection Labor’s implicit definition of privatisation is legitimate. Medicare is a relatively modest scheme of socialized medicine by some international comparisons: providing for the costs of a variety of consultative services and procedures publicly. Nonetheless, Medicare contains national health costs radically compared with the overwhelming dependence on private health cover in the United States. The danger, though, is that we are developing into a ‘two tiered’ health system in health as in education. With increasing degeneration into Galbraith’s ‘private affluence, public squalor’. This - accompanied by growing out-of-pocket expenses - would be both inefficient and unfair: an expression of the principle of privatisation as opposed to socialisation. But Medicare must be extended as well as defended. Medicare does not include dental and physiotherapy , or medical aids like glasses, hearing aids or prostheses. We need a reforming government which provides for this through the progressive reform and extension of the popular Medicare Levy without austerity elsewhere.

Hanson’s Pitch: as ‘an Ordinary Australian’ against ‘Left Elites’

Watching QandA it appears to be a deliberate strategy from Pauline Hanson to appear inarticulate; 'kind of naive'; an ‘outsider’ amidst so-called ‘elites’.- There are people who can identify with that ; and when we attack Hanson in some ways they just identify with her even more. It makes her look like 'the victim'. Pauline Hanson’s 'comeback' was stirred up in sections of the media ; appearances on morning television etc. Thankfully, her party is not strongly organized. It is built around a 'personality' and will fade again when she leaves the political scene. Also, thankfully her organization perhaps detracts from the 'United Patriots Front' and similar extreme-right groups... Perhaps it detracts from a full-on ideologically-committed and violent fascist organization. But the fear and disrespect she sows nonetheless disrupt the cohesion of our society. The best place to start for progressives is to acknowledge and address the insecurities that Hanson and other Right-wing forces take advantage of. Exploitation of foreign workers undercutting local jobs. Confusion in the wake of the erosion of ‘traditional’ Australian identity and communities. Pockets of isolation, insecurity, and exclusion. A failure to engage with those affected; dismissed casually as ‘bogans’. (perhaps itself a ‘class-based put-down’)

A Question to QandA for Sam Dastyari that was not Used

Senator Sam Dastyari ; You are on record identifying $31 Billion yearly in Corporate Tax Avoidance. But earlier this year Bill Shorten announced policies which would wind back only $2 billion of this over four years. Why has no political party moved to wind back a significant proportion of Corporate Tax Avoidance? ALSO: With US Company Taxes up to 39% - would Labor reverse Company Tax cuts so business 'pays their fair share' for infrastructure and services they benefit from?